Back to the news list

Back to the news list

Despite two big corporate transactions in the third quarter, the number of U.S. upstream oil and gas deals was tied with the first quarter for the slowest pace of mergers and acquisitions in 10 years, oil and gas data analytics company Enverus said in its quarterly M&A report on Monday.

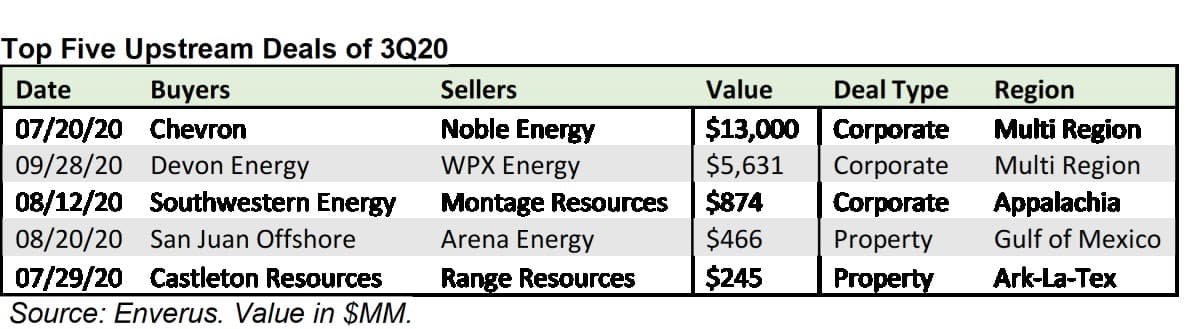

The third quarter of this year saw 28 upstream deals with disclosed value—the worst showing in a decade. However, two big corporate transactions, Chevron’s acquisition of Noble Energy and the Devon Energy-WPX Energy merger, pushed the total value of Q3 upstream transactions at US$21 billion, Enverus said, noting that it is a strong quarterly deal total by historical standards.

Top Five Upstream Deals of 3Q20

In Q2, the appetite for deal-making was so low that Q2 ranked as the third-lowest quarterly value of upstream deals since 2009, Enverus said in its report for the second quarter M&As in July.

The low number of upstream M&A deals in Q3 is likely to remain sluggish for the rest of the year, as companies are not in a spending mode anyway while finding the right M&A target could be challenging, according to Enverus.

Consolidation in the U.S. patch is underway, but it will likely take a few more years after the companies see how the recovery from the pandemic will go.

“There is a broad consensus that consolidation is a net positive for the industry,” Enverus Senior M&A Analyst Andrew Dittmar said in a statement.

“Including the corporate deals from 2019, that process looks to be well underway. There is room for further mergers, but it can be a challenge to find the right asset and balance sheet fits for accretive deals. It may take several more years for consolidation to play out,” Dittmar added.

Analyzing the Q3 deals, Enverus noted that the mergers targeted companies with manageable debt, while “Companies with impaired balance sheets are being left to find their own way, resulting in a spate of Chapter 11 filings.”

Dozens of U.S. oil and gas companies have filed for bankruptcy protection this year, and analysts expect more bankruptcies in the coming weeks and months.

Không thể sao chép